With interest rates continuing to rise and impending fiscal doom poking its head over the horizon, the housing question presents itself yet again. In fact, the housing question isn’t a single question: It is many questions, including why do so many working class people find themselves living in such poor housing? Is the ‘dream’ of home ownership really a dream? And can any government in a capitalist system play a part in the creation of affordable, decent housing for working class people?

A recent report by the National Housing Federation reveals that over 310,000 children in England are forced to share a bed with other family members due to overcrowding because of a chronic shortage of affordable housing. Funding for affordable housing was cut by 63% in 2010 as part of the Government’s brutal austerity measures, which caused a slump in the number of new social houses being built, a slump that has bottomed out with just over 6,500 social houses for rent being built in 2022.

The average age of a first-time buyer of a house is just short of 34 years old. The average price of a first-time buyer’s house is almost £250,000 – over £450,000 if they buy their first home in London. Buying a house anywhere in Britain requires an average deposit of over £60,000. Hundreds of thousands of people wanting to move out of their parents’ home, yet are ineligible for social housing and unable to save the huge deposit required to buy a home will rent privately, trapping themselves in a cycle of paying inflated rents whilst being unable to save a deposit from their disposable income. This is why over a third of the total number of occupants of homes in Britain are classified as ‘non-owner occupants’: either trapped in the private renting cycle or living with their parents.

Over the course of the last forty years in Britain, Governmental policy and the continuing atrophy of late stage capitalism has created a system where access to a ‘council house’ is impossible for anyone not drawing benefits. Local councils have had the right to sell their houses to tenants since the mid 1930s, however the Conservative Government’s ‘Right to Buy’ policy, which was enshrined in the Housing Act of 1980, gave council housing tenants who had lived in their home for over three years the right to purchase it with a 33% discount on the market rate. If they were buying a flat, they would be granted a 44% discount, while if they had been a tenant for 20 years or more, they would get a huge 50% discount on the price.

Perhaps unsurprisingly, one in three council house tenants opted to buy their home. Michael Heseltine, who was Secretary of State for the Environment, proclaimed that the policy gave people ‘what they wanted’, in effect fulfilling the ‘dream’ of home ownership, as well as what the Conservatives perceived as a vital severing of a fundamental tie between the individual and the state.

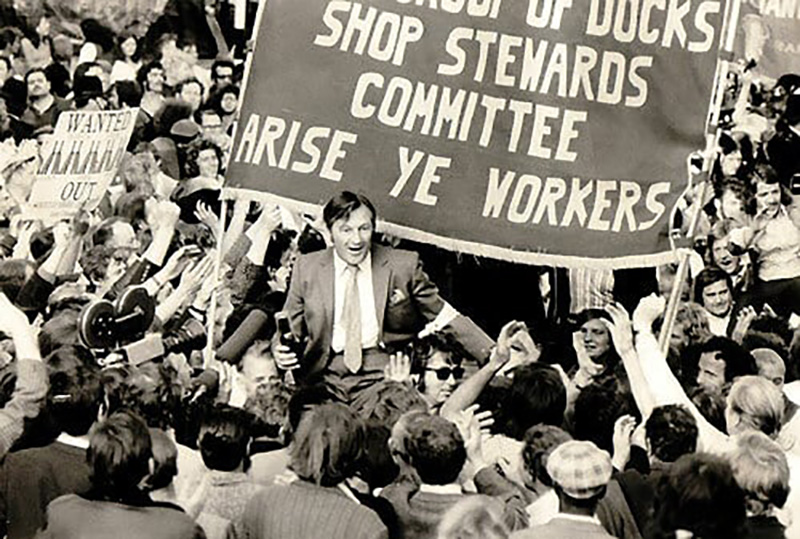

In actual fact, their policy was intended to achieve neither of these things: Firstly, it was a mass privatisation of council housing, which relieved councils across the country of millions of pounds of financial and legal obligations to manage and maintain their own housing stock; secondly, it was intended and indeed did cause a culture shift in the attitudes of working class people that, as they now owned property, something that was often beyond the reach of their parents and grandparents, they were no longer working class and, most perniciously, it was a policy specifically designed to trap working class people in debt after a decade of bitter class struggle in the 1970s. If working class people could be placed into a position where the potential loss of their home was an outcome of taking strike action, then they would be less inclined to support or take part in any such action. They may even be less inclined to join a trade union in the first place.

Subsequent to this was a second wave of mass privatisation of council housing stock with the proliferation of ‘housing associations’: non-government organisations which took over the management of council housing stock. One of the reasons councils did this was because the Thatcher Government’s ‘Right to Buy’ policies prohibited councils from subsidising rents from local rates, as well as legally ring-fenced any money they received from selling existing council housing whilst at the same time preventing them from spending that money on building new homes. This left the transfer of council housing stock to housing associations as the only option open to councils if new affordably-rented properties needed to be built, unless the council was prepared to borrow in order to build houses, which they weren’t.

Alongside this, the collapse in decent private pension provision in the last thirty or so years has led to an explosion in individuals with the financial means to do so taking second mortgages, often renting out their first home when moving into a subsequent home, with access to easy credit in the form of interest-only and buy-to-let mortgages in the pre-2008 period leading to a proliferation in people holding multiple mortgages for homes they would sell or let for an additional income in retirement.

Other well-remunerated individuals have invested in property in locations such as the Lake District, the Peak District, Dorset and Devon as holiday homes, not only for themselves to use but to let to staycationers through agents. This has created a situation where locally-born people from these areas have no opportunity to buy a home locally because they are in a price bracket that is way beyond their reach, especially where work is often less well paid than in major urban areas and seasonal. To compound the crisis further, the demand and the cost for houses in these areas and others like it increased exponentially during the Covid crisis, as many white collar workers who were told by the State to work from home brought forward their plans to escape to the country and sold their homes in urban areas and moved to more rural locations to work from home there.

All these factors and others have created a housing crisis which the capitalist class cannot solve. To those that say that Governments have choices and the policies which have created the housing crisis are among them, consider this: Of all the asset bubbles created prior to the financial crash of 2008, the housing market bubble was the only one which the Government was able to restore by maintaining base interest rates at practically zero for almost fourteen years and perpetuating the decades-old constrictions in the supply of both private housing and ‘council’ housing. To build council houses at any rate now, let alone the mass building on a scale not seen in this country since the 1950s, would simply implode the whole housing market and, in all likelihood, take the entire British economy with it.

As we can clearly see, British capitalism has reached a dead end where attempting to repair it will only lead it to implode. It is for this reason that the only viable route out of the housing crisis is socialism: A system whereby the people can build good quality houses as and when needs dictate, with permanent tenancies and at affordable rents, without any of these steps crashing the entire economy.

Leave a reply to Why Are Birth Rates Declining? – The Middle Aged Revolutionary Cancel reply